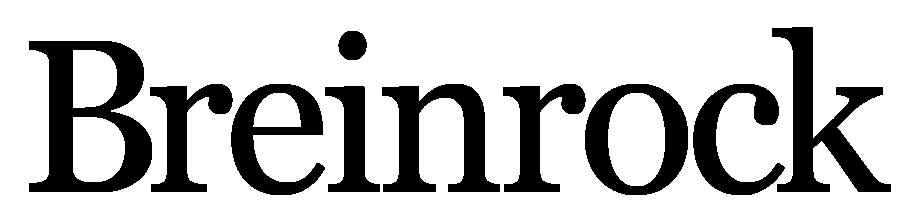

The Unstoppable Rise of BaaS: Transforming Banking with Corporate IBANs, Prepaid Cards, and Neobanking

As we move into 2024, the financial sector is going through a transformative shift propelled by the rise of Banking as a Service (BaaS). According to a comprehensive research report by Market Research Future (MRFR), the BaaS market is predicted to grow substantially during the forecast period of 2022 to 2030, boasting a CAGR of approximately 15.1%. By the end of 2030, the market is projected to attain a remarkable valuation of around USD 65.95 Billion. Looking at these statistics, there’s a clear demand for BaaS services from traditional & neo-banks on a global scale.

Personal & Corporate IBANs: Unlocking Global Financial Opportunities

Corporate IBANs have emerged as a crucial component of BaaS, offering businesses efficient solutions for international financial transactions. The global market for BaaS, valued at USD 18.21 billion in 2021, is witnessing significant revenue growth, driven by fintech innovations and a rising demand for scalable customer service and support.

Breinrock, aligning with this trend, provides Corporate IBAN solutions, facilitating seamless international business payments and enabling businesses to set up multi-currency IBANs. The adoption of Corporate IBANs not only streamlines international business payments but also enhances FX rate optimization and minimizes the challenges associated with forex risk management.

Prepaid Cards for Expense Management

The BaaS market’s substantial growth is headed by crucial innovations in banking security products and services. Breinrock, in response to this trend, offers business prepaid cards and corporate expense cards, empowering companies with employee spending cards for streamlined expense management. These prepaid card solutions not only enhance financial control but also contribute to a more efficient and pleasurable banking experience.

As businesses explore expense management cards, the BaaS ecosystem is paving the way for innovative solutions like prepaid cards, addressing the evolving needs of modern businesses and contributing to the BaaS market’s significant revenue surge.

Neobanking: Redefining Modern Banking for Businesses

In the realm of neobanking, Breinrock stands at the forefront, offering neo bank account services and modern banking solutions. Fintech neobanking is reshaping online banking platforms, providing businesses with secure e-banking systems and online financial management tools. The neobanking surge is evident in the market, with a growing demand for online neobanking platforms projected to reach unprecedented levels.

As businesses seek reliable partners in their financial journey, the promise of neobanking for businesses becomes more evident. Breinrock’s commitment to being more than just a financial company, but a partner evolving to meet a wide range of financial requirements, aligns seamlessly with the neobanking ethos.

Key Insights:

BaaS Market Growth: According to MRFR’s report, the BaaS market is predicted to achieve a valuation of around USD 65.95 Billion by the end of 2030, growing at a CAGR of approximately 15.1% during the forecast period.

Corporate IBANs and International Business Payments: Corporate IBAN solutions, a crucial aspect of BaaS, are contributing to the significant revenue growth in the global market, driven by fintech innovations and a rising demand for scalable customer service and support.

Prepaid Cards and Expense Management: The BaaS market’s growth is fueled by crucial innovations in banking security products and services. Breinrock’s prepaid card solutions contribute to a more efficient and pleasurable banking experience, aligning with the evolving needs of modern businesses.

In conclusion, the rise of BaaS, supported by the above stats, is reshaping the banking and finance industry. Breinrock, as a rapidly growing force in this landscape, embraces corporate IBANs, prepaid cards, and neobanking solutions to provide businesses with personalized financial transactions, setting the stage for a future where innovation and strategic financial solutions pave the way for success.